National Pension Scheme

National Pension Scheme India is a voluntary and long-term investment plan for retirement under the purview of the Pension Fund Regulatory and Development Authority (PFRDA) and Central Government.

1. What is NPS ( National Pension Scheme )?

The National Pension Scheme is a social security initiative by the Central Government. This pension program is open to employees from the public, private and even the unorganized sectors with the exception of those from the armed forces. The scheme encourages people to invest in a pension account at regular intervals during the course of their employment. After retirement, the subscribers can take out a certain percentage of the corpus. As an NPS account holder, you will receive the remaining amount as a monthly pension post your retirement.

Earlier, the NPS scheme covered only the Central Government employees. Now, however, the PFRDA has made it open to all Indian citizens on a voluntary basis. NPS scheme holds immense value for anyone who works in the private sector and requires a regular pension after retirement. The scheme is portable across jobs and locations, with tax benefits under Section 80C and Section 80CCD

2. Who should invest in the NPS?

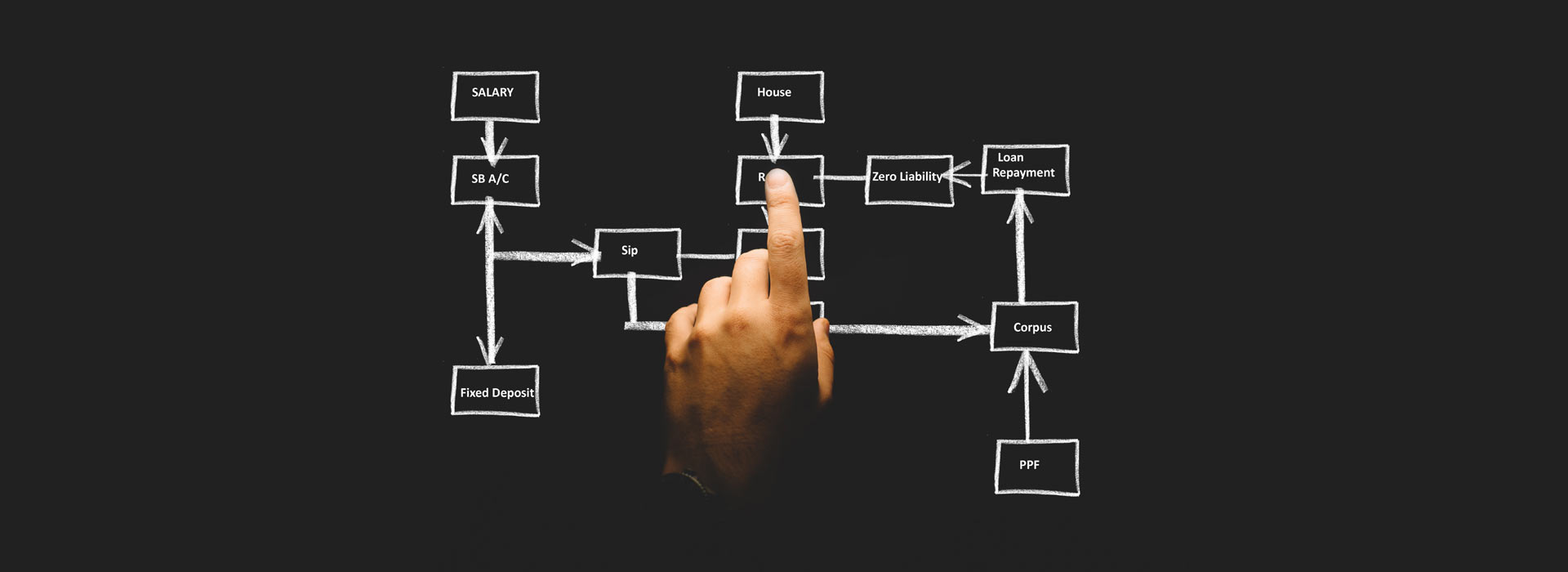

The NPS is a good scheme for anyone who wants to plan for their retirement early on and has a low-risk appetite. A regular pension (income) in your retirement years will no doubt be a boon, especially for those individuals who retire from private sector jobs. A systematic investment like this can make a massive difference to your life post-retirement. In fact, Salaried people who want to make the most of the 80C deductions can also consider this scheme.

3. Features & Benefits of NPS

a. Returns/Interest

A portion of the NPS goes to equities (this may not offer guaranteed returns). However, it offers returns that are much higher than other traditional tax-saving investments like the PPF. This scheme has been in effect for over a decade, and so far has delivered 8% to 10% annualized returns. In NPS you are also allowed the option to change your fund manager if you are not happy with the performance of the fund.

b. Risk Assessment

Currently, there exists a cap in the range of 75% to 50% on equity exposure for the National Pension Scheme. For government employees, this cap is 50%. In the range prescribed, the equity portion will reduce by 2.5% each year beginning from the year in which the investor turns 50 years of age. However, for an investor of the age 60 years and above, the cap is fixed at 50%. This stabilizes the risk-return equation in the interest of investors, which means the corpus is somewhat safe from the equity market volatility. The earning potential of NPS is higher as compared to other fixed income schemes.

c. Tax efficiency – NPS tax benefit

There is a deduction of up to Rs. 1.5 lakhs to be claimed for NPS – for your contribution as well as for the contribution of the employer.

– 80CCD(1) covers the self-contribution, which is a part of Section 80C. The maximum deduction one can claim under 80CCD(1) is 10% of the salary, but no more than the said limit. For the self-employed taxpayer, this limit is 20% of the gross income.

– 80CCD(2) covers the employer’s NPS contribution, which will not form a part of Section 80C. This benefit is not available for self-employed taxpayers. The maximum amount eligible for deduction will be lowest of the below: a. Actual NPS contribution by employer b. 10% of Basic + DA c. Gross total income

– You can claim any additional self contribution (up to Rs 50,000) under section 80CCD(1B) as NPS tax benefit.

The scheme, therefore, allows a tax deduction of up to Rs 2 lakh in total.

d. Withdrawal Rules After 60

Contrary to common belief, you cannot withdraw the entire corpus of the NPS scheme after your retirement. You are compulsorily required to keep aside at least 40% of the corpus to receive a regular pension from a PFRDA-registered insurance firm. The remaining 60% is tax-free now.

e. Early Withdrawal and Exit rules

As a pension scheme, it is important for you to continue investing until the age of 60. However, if you have been investing for at least 3 years, you may withdraw up to 25% for certain purposes. These include children’s wedding or higher studies, building/buying a house or medical treatment of self/family, among others. You can make a withdrawal for up to 3 times (with a gap of 5 years) in the entire tenure. These restrictions are only imposed on tier I accounts and not on tier II accounts. Scroll down for more details on them.

f. Equity Allocation Rules

The NPS invests in different schemes, and the Scheme E of the NPS invests in equity. You can allocate a maximum of 50% of your investment to equities. There are two options to invest in – auto choice or active choice. The auto choice decides the risk profile of your investments as per your age. For instance, the older you are, the more stable and less risky your investments. The active choice allows you to decide the scheme and to split your investments.

g. Option to change the Scheme or Fund Manager

With NPS, you have the provision to change the pension scheme or the fund manager if you are not happy with their performance. This option is available for both tier I and tier II accounts.

4. How to open an NPS account

PFRDA regulates the operations of the NPS, and they offer both an online as well as an offline means to open this account.

a. Offline Process

To open an NPS account offline or manually, you will have to find a PoP-Point of Presence, ( it could be a bank too) first. Collect a subscriber form from your nearest PoP and submit it along with the KYC papers. Ignore if you are already KYC-compliant with that bank. Once you make the initial investment (not less than Rs. 500 or Rs. 250 monthly or Rs. 1,000 annually), the PoP will send you a PRAN – Permanent Retirement Account Number. This number and the password in your sealed welcome kit will help you operate your account. There is a one-time registration fee of Rs.125 for this process.

b. Online Process

It is now possible to open an NPS account in less than half an hour. Opening an account online (enps.nsdl.com) is easy, if you link your account to your PAN, Aadhaar and/or mobile number. You can validate the registration using the OTP sent to your mobile. This will generate a PRAN (Permanent Retirement Account Number), which you can use for NPS login.

5. Types of NPS Account

The two primary account types under the NPS are tier I and tier II. The former is the default account while the latter is a voluntary addition. The table below explains the two account types in detail.

| Particulars | NPS Tier-I Account | NPS Tier-II Account |

| Status | Default | Voluntary |

| Withdrawals | Not permitted | Permitted |

| Tax exemption | Up to Rs 2 lakh p.a.(Under 80C and 80CCD) | 1.5 lakh for government employees Other employees-None |

| Minimum NPS contribution | Rs 500 or Rs 500 or Rs 1,000 p.a. | Rs 250 |

| Maximum NPS contribution | No limit | No limit |

The Tier-I account is mandatory for everyone who opts for NPS scheme. Central Government employees have to contribute 10% of their basic salary. For everyone else, the NPS is a voluntary investment option.

6. Comparing NPS scheme with other Tax Saving Instruments

Apart from the NPS, the other popular tax-saving investment options under Section 80C are Equity Linked Savings Scheme (ELSS), Public Provident Fund (PPF) and Tax-saving Fixed Deposits (FD). Here is how they are in comparison to the NPS:

| Investment | Interest | Lock-in period | Risk Profile |

| NPS | 8% to 10% (expected) | Till retirement | Market-related risks |

| ELSS | 12% to 15% (expected) | 3 years | Market-related risks |

| PPF | 8.1% (guaranteed) | 15 years | Risk-free |

| FD | 7% to 9% (guaranteed) | 5 years | Risk-free |

The NPS can earn higher returns than the PPF or FDs, but it is not as tax-efficient upon maturity. For instance, you can withdraw up to 60% of your accumulated amount from your NPS account. Out of this, 20% is taxable. Taxability on NPS withdrawal is subject to change.

7. Comparing NPS with ELSS

The good thing about the National Pension Scheme is that it has equity allocation, but the equity allocation is still not as much as tax-saving mutual funds. Equity Linked Savings Schemes invest primarily in equities and have the capacity to generate higher returns than the NPS. The lock-in period of tax-saving mutual funds is also lesser than NPS – only 3 years compared to NPS. Also, if you are an aggressive risk-seeker, equity exposure by NPS won’t be sufficient in the long run. Since ELSS can meet that requirement, it serves investors with more risk-appetite better.

Summary

Hence, consider investing in NPS scheme if the benefits elaborated above match your risk profile and investment goal. However, if you are open to more equity exposure, there are many mutual funds catering to investors from diverse backgrounds available.

For further information on NPS or explore the opportunities through mutual funds please visit mutual funds section or call on +91 7012643303 or +91 9446716166.